Archive for the ‘Fiscal Policy’ Category

Fiscal Irresponsibility

The CBO preliminarily estimates the cost impact of the House healthcare bill to be $1,042,000,000,000 over a 10 year period.

The Joint Committee on Taxation estimates that the proposed income tax surcharge and other revenue raising items will raise $583,000,000,000. Superficially, you would think that the House has “paid for” roughly 56% of the cost of the healthcare insurance provisions in this bill. That’s what House Democrats want you to think. But you would be very wrong.

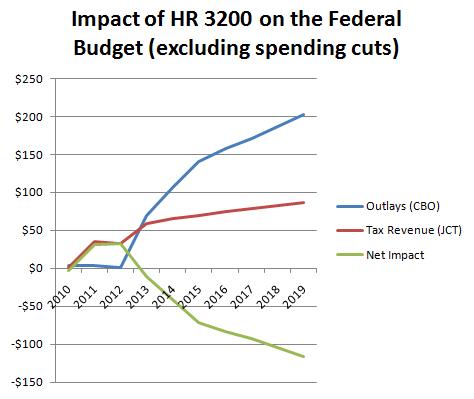

The taxation would begin in 2011. The spending would begin a phase-in in 2013. By the time the spending is fully phased in, the annual tax revenues would pay for less than 45% of the spending provisions. By 2019, there’s a $115,000,000,000 per year hole blown into the federal budget, prior to the anticipated but still unscored Medicare spending reductions. The longer you extend the horizon, the less of this program they have actually paid for.

This is represented graphically below. The next time someone says that these bills will be “paid for”, remember that you can play funny games with the 10-year scoring window. Frontloading revenues and backloading spending is just one of those games. We didn’t hire these people to plays games with us, however. We hired them to govern us like adults. Time they started acting like them.

(note: it is possible that the Medicare cuts they come up with will exponentially grow in size; I am skeptical, however. Congress doesn’t have a good history with long-term and effective cuts in Medicare, nor are the truly serious delivery system reforms on the table any longer, as best as I can see. I also don’t believe that magic prevention improvements will ever end up giving us long-term cost savings, let alone exponentially increasing cost savings as required to pay for this sort of program.)

(BTW, this is a bipartisan maturity problem; the Republicans rammed through an entirely unfunded Medicare Part D program using similar budget gimmicks)

Budget Arbritrage Strikes Healthcare Reform

In December, the CBO gave Congress a buffet-like price list on how to pay for healthcare reform. The likely result of that approach is that lawmakers would comb through the CBO options, find those that were based on the flimsiest assumptions and/or that were fundamentally mis-estimated. I believe that has happened with healthcare reform, and there’s some evidence from Arkansas’ own Senator Blanche Lincoln.

“Everything’s on the table,” Lincoln is quoted as saying in today’s Arkansas Democrat-Gazette. She suggests that she might support taxing healthcare benefits, but only at a level that “would certainly be way above anything that your average Arkansan is paying for health care — if it occurs at all.” Implicitly she’s arguing that the hundreds of billions of revenue that the CBO estimates will flow from taxing healthcare benefits greater than $17,000 or $20,000 per employee may not “occur at all” … yet it appears to be on the table as one way the plan can be “paid for”.

I’d call this the “strong form” of budget arbitrage. Specifically, budget arbitrate can happen simply because of the uncertainty of the estimates; in such cases, however, the uncertainty could go either way. Let’s call that the “weak form”. In the “strong” form, Congressmen specifically “select” against the CBO in a non-deficit neutral way. The bill will appear to be “paid for”, but the needed revenue offsets fail to appear. That may be what is happening here.

Specifically, I suspect the CBO models are failing on at least one of two dimensions with respect to this particular revenue proposal.

1) We don’t know exactly who is paying more than $17,000 per year today. This uncertainty is emphasized by a recent paper by Gould and Minicozzi. Note that this paper was published this year, after the CBO options were presented in December, 2008. They hypothesize and show some evidence in support of the notion that the people paying these high premiums are disproportionately sicker, older, and in smaller groups in high cost areas, perhaps in areas that also have relatively limited rate regulation. Under Healthcare Reform, will those high rates continue to exist, or will those high cost individuals enjoy subsidization from the rest of us? If their premiums get lowered, there may not be any tax revenue there at all. And if they don’t, you have to wonder whether healthcare reform is worth doing.

2) We don’t know how those offering and buying those plans will adjust to the taxation of their “excess” benefits. Even if healthcare reform doesn’t lower premiums for the sickest and costliest among us in the small group market (as per my previous point), these firms might change their behavior and simply lower the value of their benefits to avoid taxation. As an outsider, I suspect that this sort of dynamic response may not be fully incorporated into the CBO’s models.

These are just educated guesses. Alex Minicozzi is one of the 50 economists working at the CBO on healthcare reform, and she’s the coauthor mentioned in the aforementioned paper. So the core intellectual base is there in the CBO to minimize the damage from this situation. On the other hand, these models are very complicated and take considerable time to evolve. And I’m just not sure anyone could accurately reflect what will happen to “high tail” health premiums. This smells a lot like Bush I’s luxury taxes that raised very little revenue.

Lincoln is smelling the same thing, apparently. Let’s see if she’ll consider this a valid option to “pay for” reform.

Defining “Budget Arbitrage”

Budget Arbitrage — n. the act of “paying for” relatively certain short-term spending proposals by “reducing” highly uncertain longer-term spending. Budget arbitrage takes advantage of the fact that CBO scoring does not risk-adjust scored spending based upon the likelihood that the underlying assumptions are accurate.

Budget arbitrage is the natural result of a political process that attempts to find the politically least costly method of “paying for” current spending. The more uncertain the estimate of the future, the less likely there will be political opposition to the future cut. In contrast, the more certain the short-term spending is, the more certain is the short-term political gain.

One classic example was HR6331, where an increase in physician payments beginning immediately (July 1, 2008) were “paid for”, in part, by asserting a network requirement on Medicare Advantage providers. This network requirement was estimated to reduce the attractiveness of Medicare Advantage and, therefore, reduce enrollment and corresponding costs to CMS. This requirement is to become effective on January 1, 2011, 43 months after the increased expenditures were to begin. This was estimated to save substantial sums of money despite the possibility that many Medicare Advantage providers might move their membership from FFS plans, regardless. If that would have happened the deficit would have been lower and Congress would have had to find alternative means to fund the short-term and immediate spending increases.

The net effect of “paying for” the physician fee increase was to increase the short-term deficit and potentially increase the long-term deficit, as well.

Notably, the Medicare Advantage “cuts” in the bill were estimated to more than pay for the short-term physician fee increases. Rather than “apply” the estimated excess to future deficit reduction, the difference was “spent” in a “Medicare Improvement Fund” that would accumulate significant funds. In that manner a highly uncertain savings estimate for the years 2014-2017 was transformed into a guaranteed source of future revenues in case additional spending is desired in future Congresses. This is true regardless of whether or not 2011 Medicare Advantage enrollment validates or invalidates the estimates used by the CBO in 2008.

A summary of HR6331 is here.

Burning Down the House

Update, 2/22: The provision referenced in this post was removed in conference and did not become law.

The $15,000 homebuyers credit in the Senate version of the stimulus bill needs to be opposed. The CBPP and Kash Minori have this exactly right. What drives me to post is that there are even more reasons to oppose it than they suggest.

1) The credit could increase the supply of houses because it applies to existing homeowners. Risk-averse owners looking to “trade-up” are likely to put their homes on the market before entering the market themselves. This would not only undercut the rationale for the credit, it might even make the housing situation worse.

2) For most owners, the price of your house today isn’t nearly as important as the price of your house at the time you wish to sell. Temporarily propping house prices up today — which I don’t think this credit will effectively do — does nothing to change the price of houses tomorrow. At the end of 2010, we’ll be in basically the same position we are today; the bill just encourages likely 2010 sales to get bumped forward in time to 2009.

The one possible exception is the degree to which this credit can draw in marginal new purchasers, increasing the demand for homeownership in total. If we assume that home prices have not yet bottomed out, however, the more likely scenario is that there just aren’t many buyers for whom the credit itself is the difference between successful home ownership and foreclosure.

3) The credit may destroy economic well-being. Here’s how. Let’s put some numbers with this, and suppose that I’d have to be compensated at least $10,000 to go to the trouble to move. This credit may, therefore, induce me to move. I’ll be $5,000 better off. However, the government is $15,000 worse off. As a nation, therefore, we’ve just burned $10,000, net, to churn homes and disrupt lives.

The CBPP and Kash have very good, first-order reasons to oppose the credit, mine are secondary. The main point is that we are going to spend a lot of money to “boost” the economy. Let’s be sure that these “boosts” are cost-effective and actually help people. We have enough time to make sure we do that.

Concord Coalition on SCHIP

I just ran across this excellent Concord Coalition analysis of SCHIP funding proposals. They brought new information to bear on two points.

First, the funding for SCHIP runs for 5 years, after which it “sunsets” and has to be reappropriated. Unlike the CC, I don’t view this as a bad thing. However, this version is additionally cynical because it provides for a one-time special appropriation in 2012. This appropriation is not scored as an expenditure by the CBO.

Second, the use of the cigarette tax to raise offsetting revenue is an especially poor vehicle. SCHIP expenses are likely to increase faster than the rate of inflation and for as long as the eye can see. Cigarette taxes will fund the program. But as their graphic (reproduced below) illustrates, cigarette tax revenue tends to decline over time, not increase.

Combined, these two political gimmicks suggest that the bill builds in unfortunate long-term funding imbalances.

Smoking and low income status are correlated. Therefore, this bill brings up an additional oddity. It taxes the poor in order to give the poor some financial protection. A noble sacrifice.

You must be logged in to post a comment.